Page 106 - Continental Reinsurance 2022 Annual Report

P. 106

104 Notes to the consolidated and separate financial statements - continued

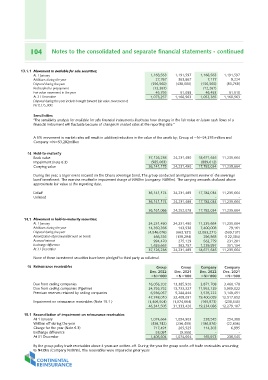

13.1.1 Movement in available for sale securities; 1,168,563 1,191,597 1,168,563 1,191,597

At 1 January 27,767 363,867 7,177 9,224

Additions during the year

Disposal during the year (156,560) (438,000) (156,560) (83,768)

Reclassied to prepayment (12,267) (12,267)

Fair value movement in the year 45,755 51,099 46,453 51,510

At 31 December 1,168,563 1,168,563

Disposal during the year include brought forward fair value movement of 1,073,257 1,053,365

N19,375,000.

Sensitivities

"The sensitivity analysis for available for sale financial instruments illustrates how changes in the fair value or future cash flows of a

financial instrument will fluctuate because of changes in market rates at the reporting date."

A 5% movement in market rates will result in addition/reduction in the value of the assets by; Group of =N=54,276 million and

Company =N=53,282million

14 Held-to-maturity 37,126,238 24,231,490 18,671,646 11,235,664

Book value (985,063) 24,231,490 (889,612) 11,235,664

Impairment (note 6.3)

Carrying value 36,141,175 17,782,034

During the year, a triger event occured on the Ghana sovereign bond. The group conducted an impairment review of the sovereign

bond investment. The exercise resulted in impairment charge of N985m (company: N890m). The carrying amounts disclosed above

approximate fair value at the reporting date.

Listed 36,141,174 24,231,489 17,782,034 11,235,664

Unlisted - - - -

36,141,174 24,231,488 17,782,034 11,235,664

36,161,066 24,252,078 17,782,034 11,235,664

14.1 Movement in held-to-maturity securities; 24,231,490 24,231,490 11,235,664 11,235,664

At 1 January 14,350,356 143,538 7,400,008 79,161

Additions during the year (4,546,076)

Disposal during the year (663,131) (2,063,271) (539,131)

Amortization of premium/discount on bonds 466,335 (138,294) 296,868 (122,384)

Accrued interest 994,470 562,779

Exchange difference 1,629,663 275,129 231,201

At 31 December 37,126,238 382,757 1,239,597 351,154

24,231,489 18,671,646 11,235,664

None of these investment securities have been pledged to third party as collateral.

15 Reinsurance receivables Group Group Company Company

Dec. 2022 Dec. 2021 Dec. 2022 Dec. 2021

Due from ceding companies =N='000 =N='000 =N='000 =N='000

Due from ceding companies (Pipeline)

Premium reserves retained by ceding companies 16,056,202 13,385,920 3,871,708 3,460,178

Impairment on reinsurance receivables (Note 15.1 ) 24,755,752 13,733,327 11,952,129 5,909,022

3,148,451

6,936,057 5,288,844 3,576,222 12,517,652

47,748,010 32,408,091 19,400,059 (238,545)

(1,406,504) (1,074,664) 12,279,107

46,341,505 31,333,426 (165,973)

19,234,086

15.1 Reconciliation of impairment on reinsurance receivables 1,074,664 1,054,903 238,545 254,388

At 1 January (438,742) (236,409) (186,876) (22,838)

Written off during the year

Charge for the year (Note 6.3) 717,491 265,525 114,303 6,995

Exchange difference 53,091 (9,355) - -

At 31 December 1,074,664

1,406,504 165,973 238,545

By the group policy trade receivables above 4 years are written-off. During the year the group wrote-off trade receivables amounting

to N439m (Company N187m). The receivables were impaired in prior years