Page 105 - Continental Reinsurance 2022 Annual Report

P. 105

Notes to the Consolidated and separate financial statements - continued 103

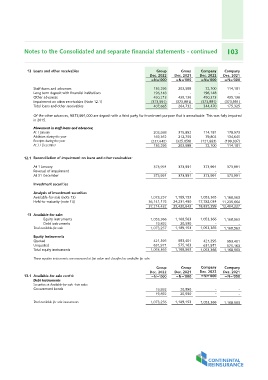

12 Loans and other receivables Group Group Company Company

Dec. 2022 Dec. 2021 Dec. 2022 Dec. 2021

Staff loans and advances =N='000 =N='000 =N='000 =N='000

Long term deposit with financial institutions

Other advances 135,295 203,588 72,100 114,181

Impairment on other receivables (Note 12.1) 196,148 - 196,148 -

Total loans and other receivables 450,213 450,213

(373,991) 435,136 (373,991) 435,136

407,665 (373,991) 344,470 (373,991)

264,732 175,325

Of the other advances, N373,991,000 are deposit with a third party for investment purpose that is unrealisable. This was fully impaired

in 2015.

Movement in staff loans and advances; 203,588 315,892 114,181 178,573

At 1 January 169,352 212,755 79,802 134,645

Additions during the year (237,645) (325,058) (199,037)

Receipts during the year 135,295 203,588 (121,883) 114,181

At 31 December 72,100

12.1 Reconciliation of impairment on loans and other receivables: 373,991 373,991 373,991 373,991

- - - -

At 1 January

Reversal of impairment 373,991 373,991 373,991 373,991

At 31 December

1,189,153

Investment securities 24,231,490

25,420,643

Analysis of investment securities 1,073,257 1,053,365 1,168,563

Available-for-sale (note 13) 36,141,175 1,168,563 17,782,034 11,235,664

Held-to-maturity (note 14) 37,214,432 20,590 18,835,399 12,404,227

13 Available-for-sale: 1,053,366 1,189,153 1,053,366 1,168,563

Equity instruments 19,892 - -

Debt instruments 593,401

1,073,257 575,163 1,053,365 1,168,563

Total available-for-sale 1,168,563

Equity Instruments 421,395 Group 421,395 593,401

Quoted 631,971 Dec. 2021 631,971

Unquoted 1,053,365 =N='000 1,053,366 575,163

Total equity instruments 1,168,563

20,590

These equities instruments are measured at fair value and classied as available-for-sale. 20,590

1,189,153

13.1 Available-for-sale cont'd: Group Company Company

Debt Instruments Dec. 2022 Dec. 2022 Dec. 2021

Securities at Available-for-sale -Fair value =N='000 =N='000 =N='000

Government bonds

19,892 - -

Total available for sale investments 19,892 - -

1,073,256 1,053,366 1,168,563