Page 104 - Continental Reinsurance 2022 Annual Report

P. 104

102 Notes to the consolidated and separate financial statements - continued

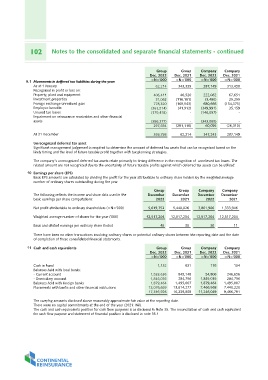

9.1 Movements in deffered tax liabilities during the year: Group Group Company Company

As at 1 January Dec. 2022 Dec. 2021 Dec. 2022 Dec. 2021

Recognised in profit or loss on: =N='000 =N='000 =N='000 =N='000

Property, plant and equipment

Investment properties 62,214 343,329 287,149 313,458

Foreign exchange unrealized gain

Employee benefits 406,411 46,520 222,062 67,651

Unused tax losses 31,062 (116,181) (3,480) 25,255

Impairment on reinsurance receivables and other financial (169,543) 680,666 (154,375)

assets 778,320 (349,991) 35,159

(361,514) (41,912) (146,097)

At 31 December (170,418) - -

(343,065)

(386,277) - 60,095 -

297,584 (281,116) (26,310)

347,243

359,798 62,214 287,149

Unrecognized deferred tax asset

Significant management judgement is required to determine the amount of deferred tax assets that can be recognized based on the

likely timing and the level of future taxable profit together with tax planning strategies.

The company’s unrecognized deferred tax assets relate primarily to timing difference in the recognition of unrelieved tax losses. The

related amount are not recognized due to the uncertainty of future taxable profits against which deferred tax assets can be utilized.

10 Earnings per share (EPS)

Basic EPS amounts are calculated by dividing the profit for the year attributable to ordinary share holders by the weighted average

number of ordinary shares outstanding during the year.

The following reflects the income and share data used in the Group Group Company Company

basic earnings per share computations: December December December December

2022 2021 2022 2021

Net profit attributable to ordinary shareholders (=N='000) 5,619,752 5,448,826 3,801,906 1,333,946

Weighted average number of shares for the year ('000) 12,517,204 12,517,204 12,517,204 12,517,204

Basis and diluted earnings per ordinary share (kobo) 45 30 30 11

There have been no other transactions involving ordinary shares or potential ordinary shares between the reporting date and the date

of completion of these consolidated financial statements.

11 Cash and cash equivalents Group Group Company Company

Dec. 2022 Dec. 2021 Dec. 2022 Dec. 2021

=N='000 =N='000 =N='000 =N='000

Cash in hand 1,132 621 176 154

Balances held with local banks:

- Current account 1,533,636 845,148 54,806 246,656

- Domiciliary account 1,845,035 284,756 1,845,035 284,756

Balances held with foreign banks 1,879,464 1,495,007 1,879,464 1,495,007

Placements with banks and other financial institutions 12,076,659 13,614,277 7,466,568 7,440,220

17,335,926 16,239,808 11,246,049 9,466,791

The carrying amounts disclosed above reasonably approximate fair value at the reporting date.

There were no capital commitments at the end of the year (2021: Nil).

The cash and cash equivalents position for cash flow purposes is as disclosed in Note 35. The reconciliation of cash and cash equivalent

for cash flow purpose and statement of financial position is disclosed in note 35.1