Page 107 - Continental Reinsurance 2022 Annual Report

P. 107

Notes to the Consolidated and separate financial statements - continued 105

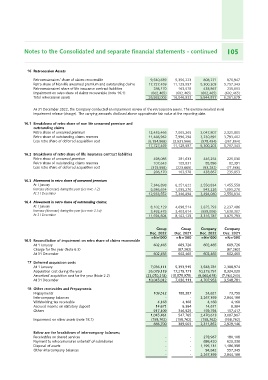

16 Retrocession Assets 9,540,839 5,356,223 808,271 870,947

17,727,459 11,129,597 5,300,203 5,757,343

Retrocessionaires’ share of claims recoverable

Retro share of Non life unearned premium and outstanding claims 286,170 163,578 438,867 235,853

Retrocessionaires' share of life insurance contract liabilities (602,465) (602,465) (602,465) (602,465)

Impairment on retro share of claims recoverable (note 16.1) 26,952,005 16,046,933 5,944,877 6,261,679

Total retrocession assets

At 31 December 2022, the Company conducted an impairment review of the retrocession assets. The exercise resulted in nil

impairment release (charge). The carrying amounts disclosed above approximate fair value at the reporting date.

16.1 Breakdown of retro share of non life unearned premium and 12,435,466 7,065,265 3,047,807 2,325,805

outstanding claims 11,486,962 7,996,298 3,230,891 3,793,402

Retro share of unearned premium (6,194,968) (3,931,966) (978,494) (361,864)

Retro share of outstanding claims reserves 17,727,459 11,129,597 5,300,203 5,757,343

Less retro share of deferred acquisition cost

498,086 281,633 446,254 225,030

16.2 Breakdown of retro share of life insurance contract liabilities 107,643 105,831 85,896 82,391

Retro share of unearned premium (319,558) (223,885)

Retro share of outstanding claims reserves 286,170 163,578 (93,282) (71,568)

Less retro share of deferred acquisition cost 438,867 235,853

16.3 Movement in retro share of unearned premium 7,346,898 6,251,622 2,550,834 1,455,558

At 1 January 5,586,654 1,095,276 943,226 1,095,276

Increase (decrease) during the year (see note 1.2) 12,933,552 7,346,898 2,550,834

At 31 December 3,494,060

16.4 Movement in retro share of outstanding claims; 8,102,129 4,698,514 3,875,793 2,237,486

At 1 January 3,492,475 3,403,614 (559,006) 1,638,307

Increase (decrease) during the year (see note 2.1a) 11,594,604 8,102,129 3,316,787 3,875,793

At 31 December

16.5 Reconciliation of impairment on retro share of claims recoverable Group Group Company Company

At 1 January Dec. 2022 Dec. 2021 Dec. 2022 Dec. 2021

Charge for the year (Note 6.3) =N='000 =N='000 =N='000 =N='000

At 31 December

602,465 689,726 602,465 689,726

- (87,262) - (87,262)

602,465 602,465

602,465 602,465

17 Deferred acquisition costs 7,036,111 5,393,915 3,548,781 2,388,974

At 1 January 26,079,119 17,218,171 10,219,791 8,324,020

Acquisition cost during the year (23,070,218) (15,575,975) (9,060,619) (7,164,213)

Amortized acquisition cost for the year (Note 2.2) 10,045,012 3,548,781

At 31 December 7,036,111 4,707,953

18 Other receivables and Prepayments 109,512 188,287 24,621 73,750

Prepayments - - 2,267,359 2,844,188

Intercompany balances

Withholding tax receivable 4,168 4,168 4,168 4,168

Accrued income on statutory deposit 14,671 8,384 14,671 8,384

Others 917,109 346,925 159,794 157,417

1,045,461 547,765 2,470,613 3,087,907

Impairment on other assets (note 18.1) (158,762) (158,762) (158,762) (158,762)

886,700 389,003 2,311,852 2,929,146

Below are the breakdown of intercompany balances; -- 278,967 180,108

Receivables on shared services -- 698,420 620,338

Payment to retrocesionaires onbehalf of subsidiaries -- 1,195,131 1,486,398

Disposal of assets -- 557,345

Other intercompany balances -- 94,842 2,844,188

2,267,359