Page 109 - Continental Reinsurance 2022 Annual Report

P. 109

Notes to the Consolidated and separate financial statements - continued 107

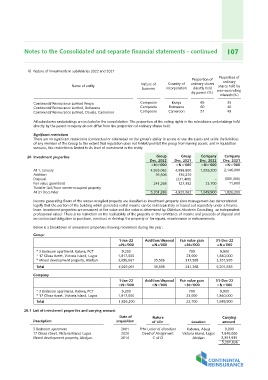

b) Nature of investments in subsidiaries 2022 and 2021 Nature of Country of Proportion of Proportion of

business incorporation ordinary shares ordinary

Name of entity

Composite directly held shares held by

Continental Reinsurance Limited Kenya Composite by parent (%) non-controlling

Continental Reinsurance Limited, Botswana Composite

Continental Reinsurance Limited, Douala, Cameroon interests(%)

Kenya 65 35

Botswana 60 40

Cameroon 51 49

All subsidiaries undertakings are included in the consolidation. The proportion of the voting rights in the subsidiaries undertakings held

directly by the parent company do not differ from the proportion of ordinary shares held.

Signicant restrictions

There are no significant restrictions (contractual or otherwise) on the group’s ability to access or use the assets and settle the liabilities

of any member of the Group to the extent that regulation does not inhibit/prohibit the group from having access, and in liquidation

scenario, this restriction is limited to its level of investment in the entity.

20 Investment properties Group Group Company Company

Dec. 2022 Dec. 2021 Dec. 2022 Dec. 2021

At 1, January =N='000 =N='000 =N='000 =N='000

Addition 1,826,200 2,146,000

Disposal 4,925,062 4,998,800

Fair value gain/(loss) 35,506 130,270 - (331,400)

Transfer (to)/from owner-occupied property - 23,700 11,600

At 31 December (331,400) -

241,268 127,392 -

- - 1,849,900 1,826,200

5,201,836 4,925,062

Income generating floors of the owner-occupied property are classified as investment property since management has demonstrated

legally that the portion of the building which generates rental income can be sold separately or leased out separately under a finance

lease. Investment properties are measured at fair value and the value is determined by Olalekan Aboderin Consulting an independent

professional valuer. There is no restriction on the realisability of the property or the remittance of income and proceeds of disposal and

no contractual obligation to purchase, construct or develop the property or for repairs, maintenance or enhancements.

Below is a breakdown of investment properties showing movement during the year;

Group: 1-Jan-22 Addition/disposal Fair value gain 31-Dec-22

=N='000 =N='000 =N='000 =N='000

* 3 Bedroom apartment, Kubwa, FCT

* 17 Olosa street, Victoria Island, Lagos 9,200 35,506 700 9,900

* Mixed development property, Abidjan. 1,817,000 35,506 23,000 1,840,000

Total 3,098,861 217,568 3,351,935

4,925,061 241,268 5,201,836

Company 1-Jan-22 Addition/disposal Fair value gain 31-Dec-22

=N='000 =N='000 =N='000 =N='000

* 3 Bedroom apartment, Kubwa, FCT

* 17 Olosa street, Victoria Island, Lagos 9,200 - 700 9,900

Total 1,817,000 23,000 1,840,000

1,826,200 23,700 1,849,900

20.1 List of Investment properties and carrying amount

Description Date of Nature Location Carrying

acquisition of title amount

Kubuwa, Abuja

3 Bedroom apartment 2001 FHA Letter of allocation Victoria Island, Lagos 9,900

17 Olosa street, Victoria Island, Lagos 2020 Deed of Assignment 1,840,000

Mixed development property, Abidjan. 2014 C of O Abidjan 3,351,935

5,201,836