Page 111 - Continental Reinsurance 2022 Annual Report

P. 111

Notes to the Consolidated and separate financial statements - continued 109

Under the DCF method, fair value is estimated using assumptions regarding the benefits and liabilities of ownership over the asset’s life

including an exit or terminal value. This method involves the projection of a series of cash flows on a real property interest. To this

projected cash flow series, a market-derived discount rate is applied to establish the present value of the income stream associated

with the asset. The exit yield is normally separately determined and differs from the discount rate.

The duration of the cash flows and the specific timing of inflows and outflows are determined by events such as rent reviews, lease

renewal and related re-letting, redevelopment, or refurbishment. The appropriate duration is typically driven by market behaviour that

is a characteristic of the class of real property. Periodic cash flow is typically estimated as gross income less vacancy, non-recoverable

expenses, collection losses, lease incentives, maintenance cost, agent and commission costs and other operating and management

expenses. The series of periodic net operating income, along with an estimate of the terminal value anticipated at the end of the

projection period, is then discounted.

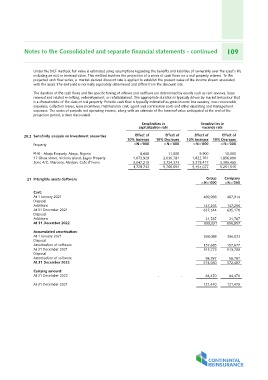

Sensitivities in Sensitivities in

capitalization rate vacancy rate

20.2 Sensitivity analysis on Investment properties Effect of Effect of Effect of Effect of

Property 10% Increase 10% Decrease

10% Increase 10% Decrease

=N='000 =N='000

=N='000 =N='000

FHA - Abuja Property, Abuja, Nigeria 8,600 11,500 9,900 10,000

17 Olosa street, Victoria Island, Lagos Property 1,673,929 2,030,781 1,822,761 1,856,090

Zone 4/C, Marcony, Abidjan, Cote d' Ivoire 3,047,215 3,724,373 3,318,417 3,385,455

4,729,743 5,766,654 5,251,545

5,151,077

21 Intangible assets-Software Group Company

=N='000 =N='000

Cost:

At 1 January 2021 489,988 487,914

Disposal - -

Additions

At 31 December 2021 147,256 147,256

Disposal 637,244 635,170

Additions

At 31 December 2022 - -

21,787 21,787

Accumulated amortisation: 659,031 656,957

At 1 January 2021

Disposal 358,088 356,023

Amortisation of software - -

At 31 December 2021

Disposal 157,685 157,677

Amortisation of software 515,773 513,700

At 31 December 2022

- -

Carrying amount: 58,787 58,787

At 31 December 2022 574,560 572,487

At 31 December 2021 -- 84,470 84,470

121,470 121,470