Page 103 - Continental Reinsurance 2022 Annual Report

P. 103

Notes to the Consolidated and separate financial statements - continued 101

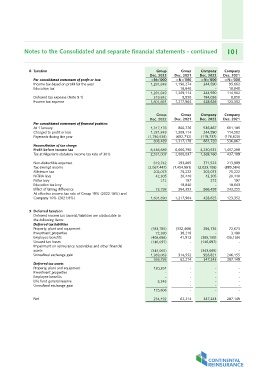

8 Taxation Group Group Company Company

Dec. 2022 Dec. 2021 Dec. 2022 Dec. 2021

Per consolidated statement of prot or loss: =N='000 =N='000 =N='000 =N='000

Income tax based on profit for the year 1,281,849 1,190,274

Education tax 244,590 95,662

- 18,840 - 18,840

Deferred tax expense (Note 9.1) 1,281,849 1,209,114 114,502

Income tax expense 244,590

319,842 8,850 184,036 8,850

Per consolidated statement of nancial position: 1,601,691 1,217,964 428,626 123,352

At 1 January

Charged to profit or loss Group Group Company Company

Payments during the year Dec. 2022 Dec. 2021 Dec. 2022 Dec. 2021

Reconciliation of tax charge 1,317,178 800,776 536,867 601,185

Profit before income tax 1,281,849 1,209,114 244,590 114,502

Tax at Nigerian's statutory income tax rate of 30% (1,790,538) (692,712) (119,737) (178,820)

1,317,178 661,720 536,867

Non-deductible expenses 808,489

Tax exempt income 6,666,790 4,230,532 1,457,298

Minimum tax 8,436,689 2,000,037 1,269,160 437,189

NITDA levy 2,531,007

Police levy 293,865 371,522 213,989

Education tax levy 819,742 (1,454,991) (2,023,106) (885,584)

Effect of timing difference (2,067,447)

At effective income tax rate of Group 19% (2022:18%) and 75,222 202,073 75,222

Company 10% (2021:8%) 202,073 20,440 42,305 20,440

42,305 212

9 Deferred taxation 212 197 - 197

Deferred income tax (assets)/liabilities are attributable to - 18,840 18,643

the following items: 73,798 264,353 566,458 243,255

Deferred tax liabilities

Property, plant and equipment 1,601,690 1,217,964 428,625 123,352

Investment properties

Employee benefits (183,785) (332,468) 294,735 72,673

Unused tax losses 72,380 38,218 - 3,480

Impairment on reinsurance receivables and other financial 41,912

assets (408,698) - (385,150) (35,159)

Unrealized exchange gain (146,097) (146,097) -

-

Deferred tax assets (343,065) 314,552 (343,065) -

Property, plant and equipment 1,369,063 926,821 246,155

Investment properties 62,214 347,243 287,149

Employee benefits 359,798

Life fund general reserve - - -

Unrealized exchange gain 120,261 - - -

- - - -

Net - - - -

- - -

5,345 - - -

-

62,214 347,243 287,149

125,606

234,192