Page 108 - Continental Reinsurance 2022 Annual Report

P. 108

106 Notes to the consolidated and separate financial statements - continued

The group has shared service arrangements where some functions are centralized. Some of the shared services include information

technology, operating softwares and licences, human capital management, Enterprise and risk management functions etc. The cost

incurred on these services are shared by all entities in the group.

Receivables on payment to retrocessionaires on behalf of subsidiaries arose from group retrocession arrangements with third parties.

In 2020 the parent company sold her investment property in Cote d' voire to her subsidiary in Cameroon with a repayment plan above

one year. The balance receivables on the disposal as at December 2022 was N1.2b (2021: 1.5b).

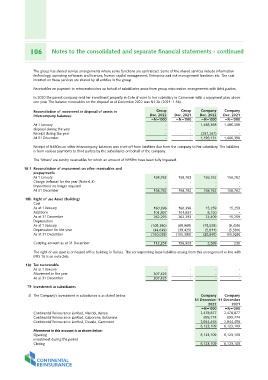

Reconciliation of movement in disposal of assets in Group Group Company Company

intercompany balances: Dec. 2022 Dec. 2021 Dec. 2022 Dec. 2021

=N='000 =N='000 =N='000 =N='000

At 1 January

disposal during the year - - 1,486,398 1,486,398

Receipt during the year - - - -

At 31 December - - -

- - (291,267)

1,195,131 1,486,398

Receipt of N480m on other intercompany balances was a set-off from liabilities due from the company to her subsidiary. The liabilities

is from various payments to third parties by the subsidiaries on behalf of the company.

The "others" are sundry receivables for which an amount of N159m have been fully impaired.

18.1 Reconciliation of impairment on other receivables and 158,762 158,762 158,762 158,762

prepayments - - - -

At 1 January - - - -

Charge (release) for the year (Note 6.3)

Impairment no longer required 158,762 158,762 158,762 158,762

At 31 December

18b Right of use Asset (Building) 160,396 160,396 15,259 15,259

Cost 101,897 101,897 8,150 -

As at 1 January 262,293 262,293

Additions 23,409 15,259

As at 31 December (105,390) (65,965)

Depreciation (44,649) (39,425) (15,029) (9,439)

As at 1 January (105,390) (5,811) (5,590)

Depreciation for the year (150,039) (15,029)

As at 31 December (20,840)

Carrying amount as at 31 December 112,254 156,903 2,569 230

The right of use asset is on leased office building in Tunisia. The corresponding lease liabilities arising from this arrangement in line with

IFRS 16 is on note 26b.

18c Tax recoverable - - --

As at 1 January 307,425 - - -

Movement in the year 307,425 - - -

As at 31 December

19 Investment in subsidiaries

a) The Company's investment in subsidiaries is as stated below: Company Company

Continental Reinsurance Limited, Nairobi, Kenya 31 December 31 December

Continental Reinsurance Limited, Gaborone, Botswana

Continental Reinsurance Limited, Douala, Cameroon 2022 2021

Movement in this account is as shown below: =N='000 =N='000

Opening

investment during the period 2,478,877 2,478,877

Closing

699,774 699,774

2,944,458 2,944,458

6,123,109 6,123,109

6,123,109 6,123,109

- -

6,123,109 6,123,109