Page 102 - Continental Reinsurance 2022 Annual Report

P. 102

100 Notes to the consolidated and separate financial statements - continued

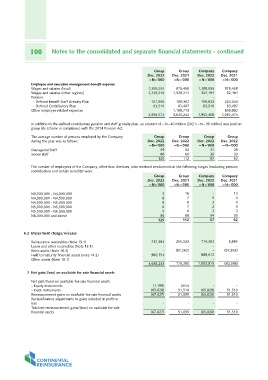

Employee and executive management benet expense Group Group Company Company

Wages and salaries (local) Dec. 2022 Dec. 2021 Dec. 2022 Dec. 2021

Wages and salaries (other regions) =N='000 =N='000 =N='000 =N='000

Pension:

1,388,055 875,458 1,388,055 875,458

- Defined Benefit Staff Gratuity Plan 2,239,018 1,328,214 324,194 62,484

- Defined Contributory Plan - -

Other employee related expenses 187,986 168,362 156,643

83,516 83,497 83,516 224,044

83,497

3,898,574 1,189,713 1,952,408

3,645,244 836,992

2,082,474

In addition to the defined contributory pension and staff gratuity plan, an amount of =N=40 million (2021:=N=39 million) was paid on

group life scheme in compliance with the 2014 Pencom Act.

The average number of persons employed by the Company Group Group Group Group

during the year was as follows: Dec. 2022 Dec. 2022 Dec. 2022 Dec. 2022

=N='000 =N='000 =N='000 =N='000

Managerial Staff

Senior staff 59 52 31 29

66 60 36 33

125 112 67 62

The number of employees of the Company, other than directors, who received emoluments in the following ranges (excluding pension

contributions and certain benefits) were:

Group Group Company Company

Dec. 2022 Dec. 2021 Dec. 2022 Dec. 2021

=N='000 =N='000 =N='000 =N='000

N3,500,001 - N4,000,000 3 16 - 13

N4,000,001 - N4,500,000 87 54

N4,500,001 - N5,000,000 88 34

N5,000,001 - N5,500,000 67 25

N5,500,001 - N6,000,000 56 33

N6,000,001 and above 95 68 54 33

125 112 67 62

6.3 Impairment charge/releases 717,491 265,525 114,303 6,995

- - - -

Reinsurance receivables (Note 15.1) - -

Loans and other receivables (Note 13.1) (87,262) (87,262)

Retro assets (Note 16.3) 980,751 - 889,612 -

Held to maturity financial assets (note 14.2) - - - -

Other assets (Note 18.1)

1,698,243 178,265 1,003,915 (80,266)

7 Net gain/(loss) on available for sale financial assets

(1,199) (411) - -

Net gain/(loss) on available-for-sale financial assets (65,828) 51,510 (65,828) 51,510

– Equity instruments (67,027) 51,099 (65,828) 51,510

– Debt Instruments

Remeasurement gains on available-for-sale financial assets - - - -

Reclassification adjustments to gains included in profit or

loss (67,027) 51,099 (65,828) 51,510

Total net remeasurement gains/(loss) on available for sale

financial assets