Page 98 - Continental Reinsurance 2022 Annual Report

P. 98

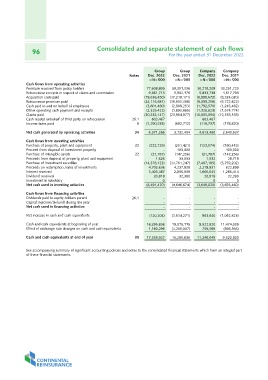

96 Consolidated and separate statement of cash flows

For the year ended 31 December 2022

Notes Group Group Company Company

Dec. 2022 Dec. 2021 Dec. 2022 Dec. 2021

=N='000 =N='000 =N='000 =N='000

Cash flows from operating activities 77,608,805 59,301,336 36,218,209 30,251,720

Premium received from policy holders

Retrocession receipts in respect of claims and commission 9,861,713 5,902,176 5,833,738 4,617,793

Acquisition costs paid

Retrocession premium paid (19,636,450) (17,218,171) (8,898,672) (8,324,020)

Cash paid to and on behalf of employees

Other operating cash payment and receipts (24,116,681) (15,503,308) (9,099,258) (5,722,622)

Claims paid

Cash receipt onbehalf of third party on retrocession (3,601,480) (2,808,253) (1,792,570) (1,245,482)

Income taxes paid

(2,325,422) (1,893,685) (1,326,623) (1,574,774)

Net cash generated by operating activities

(30,232,147) (23,954,977) (16,805,094) (15,183,158)

Cash flows from investing activities

Purchase of property, plant and equipment 26.1 603,467 - 603,467 -

Proceed from disposal of investment property

Purchase of intangible assets 8 (1,790,538) (692,712) (119,737) (178,820)

Proceeds from disposal of property, plant and equipment

Purchase of investment securities 34 6,371,266 3,132,404 4,613,460 2,640,637

Proceeds on redemption /sales of investments

Interest received 22 (222,126) (251,421) (123,074) (160,415)

Dividend received - 403,000

Investment in subsidary - 403,000

Net cash used in investing activities (21,787) (147,256)

22 (21,787) (147,256) 1,532 28,719

Cash flows from financing activities

Dividends paid to equity holders parent 1,626 33,033 (7,407,185) (5,759,202)

Capital injection/(refund) during the year 2,219,831 622,899

Net cash used in financing activities (14,378,123) (11,761,247) 1,660,045

20,818 1,286,414

Net increase in cash and cash equivalents 4,702,636 4,237,928 0 32,380

0

Cash and cash equivalents at beginning of year 3,405,487 2,806,909 (3,649,820)

Effect of exchange rate changes on cash and cash equivalents (3,693,460)

20,818 32,380

Cash and cash equivalents at end of year

0-

(6,491,470) (4,646,674)

26.1 - - - -

- - --

- - --

(120,204) (1,514,271) 963,640 (1,052,823)

16,295,836 19,015,115 9,522,820 11,474,009

1,160,296 (1,205,007) 759,589 (898,366)

35 17,335,927 16,295,836 11,246,049 9,522,820

See accompanying summary of significant accounting policies and notes to the consolidated financial statements which form an integral part

of these financial statements.