Page 113 - Continental Reinsurance 2022 Annual Report

P. 113

Notes to the Consolidated and separate financial statements - continued 111

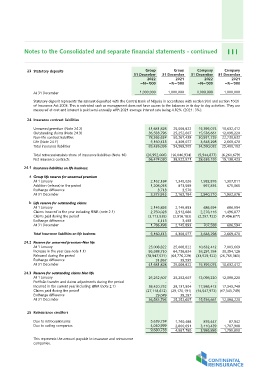

23 Statutory deposits Group Group Company Company

31 December 31 December 31 December 31 December

2022 2021 2022 2021

=N='000 =N='000 =N='000 =N='000

At 31 December 1,000,000 1,000,000 1,000,000 1,000,000

Statutory deposit represents the amount deposited with the Central Bank of Nigeria in accordance with section 9(1) and section 10(3)

of Insurance Act 2003. This is restricted cash as management does not have access to the balances in its day to day activities. They are

measured at cost and interest is paid semi-annually with 2021 average interest rate being 4.82% (2021: 3%).

24 Insurance contract liabilities 41,681,828 25,008,822 15,395,074 10,632,412

36,583,796 25,252,607 15,536,661 12,098,220

Unearned premium (Note 24.2) 78,265,624 50,261,429 30,931,735 22,730,632

Outstanding claims (Note 24.3)

Non-life contract liabilities 5,160,413 4,308,077 3,648,298 2,669,470

Life (Note 24.1) 83,426,036 54,569,505 34,580,032 25,400,102

Total insurance liabilities

(26,952,006) (16,046,934) (5,944,877) (6,261,679)

Total retrocessionaire's share of insurance liabilities (Note 16) 56,474,030 38,522,571 28,635,155 19,138,423

Net insurance contracts

2,162,184 1,345,026 1,982,876 1,307,811

24.1 Insurance liabilities on life business; 1,208,018 813,589 957,834 675,065

3,570

a Group life reserve for unearned premium 3,713 2,940,710 1,982,876

At 1 January 3,373,915 2,162,184

Addition (release) in the period

Exchange difference 2,145,893 2,145,893 686,594 686,594

At 31 December 2,750,028 2,912,686 2,278,116 1,496,877

(3,113,535) (2,916,183) (2,257,122) (1,496,877)

b Life reserve for outstanding claims

At 1 January 4,113 3,498 707,588 686,594

Claims Incurred in the year including IBNR (note 2.1) 1,786,498 2,145,893

Claims paid during the period 3,648,298 2,669,470

Exchange difference 5,160,413 4,308,077

At 31 December

25,008,822 25,008,822 10,632,412 7,003,669

Total Insurance liabilities on life business 95,588,710 64,736,634 38,291,784 30,394,126

(78,947,571) (64,776,229) (33,529,122) (26,765,383)

24.2 Reserve for unearned premium-Non life

At 1 January 31,867 39,595 15,395,074 10,632,412

Increase in the year (see note 1.1) 41,681,828 25,008,822

Released during the period

Exchange difference 25,252,607 25,252,607 12,098,220 12,098,220

At 31 December - - --

24.3 Reserve for outstanding claims-Non life 38,420,752 29,131,904 17,986,413 17,343,749

At 1 January (27,118,612) (29,170,191) (14,547,972) (17,343,749)

Portfolio transfer and claims adjustments during the period

Incurred in the current year including IBNR (note 2.1) 29,049 38,287 15,536,661 12,098,220

Claims paid during the period 36,583,796 25,252,607

Exchange difference

At 31 December

25 Reinsurance creditors 5,639,734 1,760,488 876,447 87,942

4,040,999 2,800,691 3,110,439 1,707,908

Due to retrocessionaires 9,680,733 4,561,180 3,986,886 1,795,850

Due to ceding companies

This represents the amount payable to insurance and reinsurance

companies.