Page 115 - Continental Reinsurance 2022 Annual Report

P. 115

Notes to the Consolidated and separate financial statements - continued 113

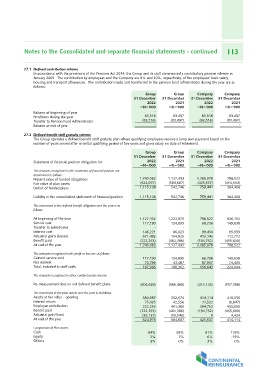

27.1 Dened contribution scheme

In accordance with the provisions of the Pensions Act 2014, the Group and its staff commenced a contributory pension scheme in

January 2005. The contribution by employees and the Company are 8% and 10%, respectively, of the employees' basic salary,

housing and transport allowances. The contribution made and transferred to the pension fund administrator during the year are as

follows:

Balance at beginning of year Group Group Company Company

Provisions during the year 31 December 31 December 31 December 31 December

Transfer to Pension Fund Administrator

Balance at end of year 2022 2021 2022 2021

=N='000 =N='000 =N='000 =N='000

- - - -

83,516 83,497 83,516 83,497

(83,516) (83,497) (83,516) (83,497)

- - - -

27.2 Dened benet staff gratuity scheme

The Group operates a defined benefit staff gratuity plan where qualifying employees receive a lump sum payment based on the

number of years served after an initial qualifying period of five years and gross salary on date of retirement.

Statement of financial position obligation for: Group Group Company Company

31 December 31 December 31 December 31 December

The amounts recognised in the statement of nancial position are

determined as follows: 2022 2021 2022 2021

Present value of funded obligations =N='000 =N='000 =N='000 =N='000

Fair value of plan assets

Deficit of funded plans 1,740,083 1,127,433 1,185,078 798,522

(624,975) (584,687) (425,637) (414,114)

1,115,108

542,746 759,441 384,408

Liability in the consolidated statement of financial position 1,115,108 542,746 759,441 384,408

The movement in the dened benet obligation over the year is as

follows:

At beginning of the year 1,127,432 1,222,975 798,522 926,152

Service cost 117,190 124,895 68,736 149,638

Transfer to subsidiaries - - -

Interest cost 146,221 86,023 99,430 -

Actuarial gains (losses) 571,492 154,925 65,559

Benefit paid 413,143 112,772

At end of the year (222,253) (461,386) (194,752) (455,600)

1,740,083 1,127,432 1,185,078 798,522

The amounts recognised in the prot or loss are as follows:

Current service cost 117,190 124,895 68,736 149,638

Net interest 70,796 43,467 87,907 74,405

Total, included in staff costs 156,643

187,986 168,362 224,044

The amounts recognised in other comprehensive income

Re-measurement loss on net defined benefit plans (606,629) (165,469) (413,143) (117,196)

The movement in the plan assets over the year is as follows: 584,687 552,674 414,114 418,536

Assets at fair value - opening 75,425 42,556 11,523 (8,847)

Interest return 455,600

Employer contribution 222,253 461,386 194,752 (455,600)

Benefit paid (222,253) (461,386) (194,752)

Actuarial gain/(loss) 4,424

At end of the year (35,137) (10,543) 0 414,114

624,975 584,687 425,637

Composition of Plan assets 119%

Cash 94% 93% 91% -19%

Equity 3% 7% 6%

Others 3% 0% 3% 0%