Page 116 - Continental Reinsurance 2022 Annual Report

P. 116

114 Notes to the consolidated and separate financial statements - continued

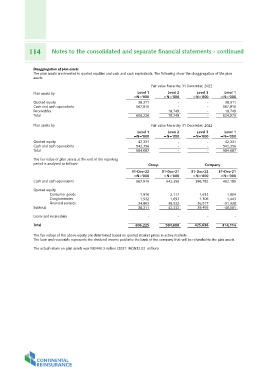

Disaggregation of plan assets

The plan assets are invested in quoted equities and cash and cash equivalents. The following show the disaggregation of the plan

assets.

Fair value hierarchy 31 December, 2022

Plan assets by Level 1 Level 2 Level 3 Level 1

=N='000 =N='000 =N='000 =N='000

Quoted equity

Cash and cash equivalents 38,311 - - 38,311

Receivables 567,915 - - 567,915

Total 18,749 -

- 18,749 - 18,749

606,226 624,975

Plan assets by Fair value hierarchy 31 December, 2022

Quoted equity Level 1 Level 2 Level 3 Level 1

Cash and cash equivalents =N='000 =N='000 =N='000 =N='000

Total

42,331 - - 42,331

The fair value of plan assets at the end of the reporting 542,356 - - 542,356

period is analysed as follows: 584,687 - - 584,687

Cash and cash equivalents Group Company

Quoted equity 31-Dec-22 31-Dec-21 31-Dec-22 31-Dec-21

Consumer goods =N='000 =N='000 =N='000 =N='000

Conglomerates

Financial services 567,915 542,356 386,182 462,195

Subtotal 1,916 2,117 1,632 1,804

1,532 1,693 1,306 1,443

Loans and receivables 34,863 38,522 36,517 -51,328

38,311 42,332 39,455 -48,081

Total

- - - -

606,225 584,688 425,636 414,114

The fair values of the above equity are determined based on quoted market prices in active markets .

The loan and receivable represents the dividend income paid into the bank of the company that will be refunded to the plan assets.

The actual return on plan assets was NGN40.3 million (2021: NGN32.02 million)