Page 149 - Continental Reinsurance 2022 Annual Report

P. 149

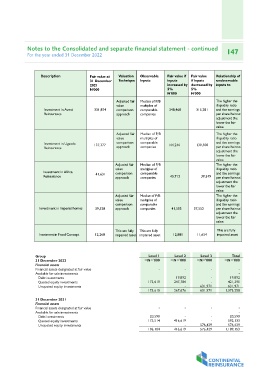

Notes to the Consolidated and separate financial statement - continued 147

For the year ended 31 December 2022

Description Fair value at Valuation Observable Fair value if Fair value Relationship of

31 December Technique Inputs inputs if inputs unobservable

Investment in Aveni 2021 increased by decreased by inputs to

Reinsurance N'000 5% 5%

N'000 N'000

Investment in Uganda

Reinsurance 331,874 Adjusted fair Median of P/B 348,468 315,281 The higher the

value multiples of illiquidity ratio

Investment in Africa comparison comparable and the earnings

Reinsurance approach companies per share haircut

adjustment the

Investment in Imperial homes lower the fair

value.

Ivestment in Food Concept

137,377 Adjusted fair Median of P/B 144,246 130,508 The higher the

value multiples of 43,712 39,549 illiquidity ratio

comparison comparable 41,505 and the earnings

approach companies 37,552 per share haircut

adjustment the

41,631 Adjusted fair Median of P/B lower the fair

value multiples of value.

comparison comparable

approach companies The higher the

illiquidity ratio

39,528 Adjusted fair Median of P/B and the earnings

value multiples of per share haircut

comparison comparable adjustment the

approach companies lower the fair

value.

The higher the

illiquidity ratio

and the earnings

per share haircut

adjustment the

lower the fair

value.

12,268 This are fully This are fully 12,881 11,654 This are fully

impaired asset impaired asset impaired asset

Group Level 1 Level 2 Level 3 Total

31 December 2022 =N='000 =N='000 =N='000 =N='000

Financial assets

Financial assets designated at fair value - - - -

Available for sale investments -

173,610 19,892 - 19,892

Debt investments 173,610 247,784 - 421,395

Quoted equity investments 631,971 631,971

Unquoted equity investments - 631,971 1,073,258

267,676

31 December 2021

Financial assets - - - -

Financial assets designated at fair value -

Available for sale investments 20,590 - - 20,590

175,514 416,619 - 592,133

Debt investments 576,429 576,429

Quoted equity investments 196,104 - 576,429 1,189,153

Unquoted equity investments 416,619