Page 144 - Continental Reinsurance 2022 Annual Report

P. 144

142 Notes to the Consolidated and separate financial statement - continued

For the year ended 31 December 2022

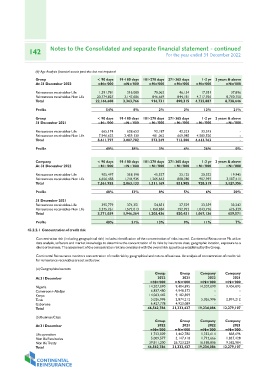

(b) Age Analysis nancial assets past due but not impaired

Group < 90 days 91-180 days 181-270 days 271-365 days 1-2 yr 2 years & above

At 31 December 2022

=N='000 =N='000 =N='000 =N='000 =N='000 =N='000

Reinsurance receivables-Life 1,391,781 216,080 70,062 46,134 17,951 37,896

Reinsurance receivables-Non Life 20,774,827 3,147,686 846,669 844,181 4,717,936 8,700,750

Total 22,166,608 3,363,766 916,731 890,315 4,735,887 8,738,646

Prole 54% 8% 2% 2% 12% 21%

Group < 90 days 91-180 days 181-270 days 271-365 days 1-2 yr 2 years & above

31 December 2021

=N='000 =N='000 =N='000 =N='000 =N='000 =N='000

Reinsurance receivables-Life 665,174 628,653 92,187 43,523 33,243 -

Reinsurance receivables-Non Life 7,946,622 2,459,130 481,062 669,985 4,580,520 -

Total 8,611,797 3,087,782 573,249 713,508 4,613,763 -

Prole 49% 18% 3% 4% 26% 0%

Company < 90 days 91-180 days 181-270 days 271-365 days 1-2 yr 2 years & above

At 31 December 2022

=N='000 =N='000 =N='000 =N='000 =N='000 =N='000

Reinsurance receivables-Life 905,497 318,198 45,527 23,125 20,322 19,945

Reinsurance receivables-Non Life 6,656,458 1,744,935 1,265,643 808,780 907,997 3,107,411

Total 7,561,955 2,063,133 1,311,169 831,905 928,319 3,127,356

Prole 48% 13% 8% 5% 6% 20%

31 December 2021 395,779 374,351 54,851 27,529 23,359 33,242

Reinsurance receivables-Life 3,375,261 1,572,013 1,150,584 792,922 1,043,776 626,329

Reinsurance receivables-Non Life 3,771,039 1,946,364 1,205,436 820,451 1,067,136 659,571

Total

Prole 40% 21% 13% 9% 11% 7%

43.2.2.1 Concentration of credit risk

Concentration risk (including geographical risk) includes identication of the concentration of risks insured. Continental Reinsurance Plc utilize

data analysis, software and market knowledge to determine the concentration of its risks by insurance class, geographic location, exposure to a

client or business. The assessment of the concentration risk are consistent with the overall risk appetite as established by the Group.

Continental Reinsurance monitors concentration of credit risk by geographical and nature of business. An analysis of concentration of credit risk

for reinsurance receivables are set out below:

(a) Geographical sectors Group Group Company Company

2022 2021 2022 2021

At 31 December

=N='000 =N='000 =N='000 =N='000

Nigeria 14,207,090 9,404,895 14,207,090 9,404,895

Cameroon+Abidjan 4,948,372

Kenya 6,837,480 9,182,859 - -

Tunis 14,063,442 2,874,212 - -

Gaborone 4,923,089 5,026,996 2,874,212

Total 5,026,996 31,333,427 - -

6,427,778 19,234,086 12,279,107

46,562,786

(b) Business Class Group Group Company Company

2022 2021 2022 2021

At 31 December

=N='000 =N='000 =N='000 =N='000

Life operation 1,742,009 1,462,780 1,332,614 858,696

Non life Facultative 5,009,577 3,147,418 1,712,666

Non life Treaty 39,811,200 26,723,229 16,188,806 1,837,428

Total 46,562,786 31,333,427 19,234,086 9,582,984

12,279,107