Page 147 - Continental Reinsurance 2022 Annual Report

P. 147

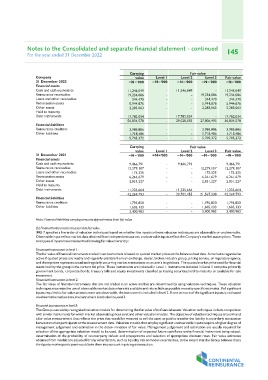

Notes to the Consolidated and separate financial statement - continued 145

For the year ended 31 December 2022

Carrying Fair value

value

Company Level 1 Level 2 Level 3 Fair value

31 December 2022 =N='000 =N='000 =N='000

Financial assets =N='000 =N='000

Cash and cash equivalents 11,246,049 - 11,246,049

Reinsurance receivables 19,234,086 - 11,246,049 - 19,234,086

Loans and other receivables - - 19,234,086

Retrocession assets 344,470 - - 344,470

Other assets 5,944,876 - - 344,470 5,944,876

Held to maturity 2,283,063 - 5,944,876 2,283,063

Debt instruments - 2,283,063

17,782,034 17,782,034

Financial liabilities 56,834,578 - 17,782,034 - 56,834,578

Reinsurance creditors - 29,028,083 27,806,495

Other liabilities 3,986,886 - 3,986,886

1,718,486 - 3,986,886 1,718,486

5,705,372 - 1,718,486 5,705,372

- 5,705,372

Carrying Fair value

value

Level 1 Level 2 Level 3 Fair value

=N='000 =N='000 =N='000

31 December 2021 =N='000 =N='000

Financial assets 9,466,791 - 9,466,791

Cash and cash equivalents 12,279,107 - 9,466,791 - 12,279,107

Reinsurance receivables - - 12,279,107

Loans and other receivables 175,325 - - 175,325

Retrocession assets 6,261,679 - - 175,325 6,261,679

Other assets 2,851,227 - 6,261,679 2,851,227

Held to maturity - 2,851,227

Debt instruments 11,235,664 11,235,664

42,269,793 - 11,235,664 - 42,269,793

Financial liabilities - 20,702,455 21,567,338

Reinsurance creditors 1,795,850 - 1,795,850

Other liabilities 1,605,133 - 1,795,850 1,605,133

3,400,983 - 1,605,133 3,400,983

- 3,400,983

Note: Financial liabilities carrying amounts approximates their fair value

(b) Financial instruments measured at fair value

IFRS 7 species a hierarchy of valuation techniques based on whether the inputs to those valuation techniques are observable or unobservable.

Observable input reect market data obtained from independent sources; unobservable inputs reect the Company's market assumptions. These

two types of inputs have created the following fair value hierarchy:

Financiual instrument in level 1:

The fair value of nancial instruments traded in active markets is based on quoted market prices at the balance sheet date. A market is regarded as

active if quoted prices are readily and regularly available from an exchange, dealer, broker, industry group, pricing service, or regulatory agency,

and those prices represent actual and regularly occurring market transactions on an arm's length basis. The quoted market price used for nancial

assets held by the group is the current bid price. These instruments are included in Level 1. Instruments included in Level 1 comprise primarily

government bonds, corporate bonds, treasury bills and equity investments classied as trading securities,held to maturity or available for sale

investment.

Financiual instrument in level 2:

The fair value of nancial instruments that are not traded in an active market are determined by using valuation techniques. These valuation

techniques maximise the use of observable market data where itis available and rely as little as possible on entity specic estimates. If all signicant

inputs required to fair value an instrument are observable, the instrument is included in level 2. If one or more of the signicant inputs is not based

on observable market data, the instrument is included in Level 3.

Financial instruments in level 3:

The Group uses widely recognised valuation models for determining the fair value of its nancial assets. Valuation techniques include comparison

with similar instruments for which market observable prices exist and other valuation models. The objective of valuation techniques is to arrive at

a fair value measurement that reects the price that would be received to sell the asset or paid to transfer the liability in an orderly transaction

between market participants at the measurement date. Valuation models that employ signicant unobservable inputs require a higher degree of

management judgement and estimation in the deter- mination of fair value. Management judgement and estimation are usually required for

selection of the appropriate valuation model to be used, determination of expected future cash ows onthe nancial instrument being valued,

determination of the probability of counterparty default and prepayments and selection of appropriate discount rates. Fair value estimates

obtained from models are adjusted for any other factors, such as liquidity risk or model uncertainties, to the extent that the Group believes that a

third party market participant would take them into account in pricing a transaction.