Page 117 - Continental Reinsurance 2022 Annual Report

P. 117

Notes to the Consolidated and separate financial statement - continued 115

For the year ended 31 December 2022

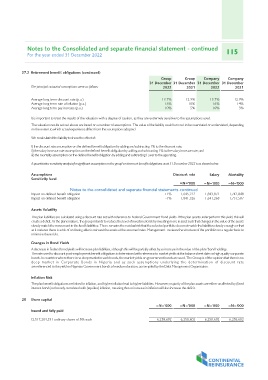

27.2 Retirement benefit obligations (continued) Group Group Company Company

The principal actuarial assumptions were as follows:

31 December 31 December 31 December 31 December

2022 2021 2022 2021

Average long term discount rate (p.a.) 13.7% 12.9% 13.7% 12.9%

Average long term rate of inflation (p.a.) 16% 10% 16% 14%

Average long term pay increase (p.a.) 10% 5% 10% 5%

It is important to treat the results of the valuation with a degree of caution, as they are extremely sensitive to the assumptions used.

The valuation results set out above are based on a number of assumptions. The value of the liability could turn out to be overstated or understated, depending

on the extent to which actual experience differs from the assumptions adopted.

We recalculated the liability to show the effect of:

I) the discount rate assumption on the defined benefit obligation by adding and subtracting 1% to the discount rate;

ii) the salary increase rate assumption on the defined benefit obligation by adding and subtracting 1% to the salary increase rate; and

iii) the mortality assumption on the defined benefit obligation by adding and subtracting 1 year to the age rating.

A quantitative sensitivity analysis for significant assumption on the group's retirement benefit obligations as at 31 December 2022 is as shown below:

Assumptions Discount rate Salary Mortality

Sensitivity level =N='000

=N='000 =N='000

Notes to the consolidated and separate nancial statements-continued

1,843,872 1,742,848

Impact on defined benefit obligation +1% 1,645,222 1,641,268 1,737,587

Impact on defined benefit obligation -1% 1,841,326

Assets Volatility

The plan liabilities are calculated using a discount rate set with reference to Federal Government Bond yields. If the plan assets underperform this yield, this will

create a deficit. As the plans mature, the group intends to reduce the level of investment risk by investing more in asset such that changes in the value of the assets

closely match the movement in the fund's liabilities. There remains the residual risk that the selected portfolio does not match the liabilities closely enough or that

as it matures there is a risk of not being able to reinvest the assets at the assumed rates. Management reviews the structure of the portfolio on a regular basis to

minimize these risks.

Changes in Bond Yields

A decrease in Federal bond yields will increase plan liabilities, although this will be partially offset by an increase in the value of the plans' bond holdings.

The rate used to discount post-employment benefit obligations is determined with reference to market yields at the balance sheet date on high quality corporate

bonds. In countries where there is no deep market in such bonds, the market yields on government bonds are used. The Group is of the opinion that there is no

deep market in Corporate Bonds in Nigeria and as such assumptions underlying the determination of discount rate

are referenced to the yield on Nigerian Government bonds of medium duration, as compiled by the Debt Management Organisation.

Inflation Risk

The plan benefit obligations are linked to inflation, and higher inflation lead to higher liabilities. However, majority of the plan assets are either unaffected by (fixed

interest bonds) or loosely correlated with (equities) inflation, meaning that an increase in inflation will also increase the deficit.

28 Share capital =N='000 =N='000 =N='000 =N='000

Issued and fully paid

12,517,204,331 ordinary shares of 50k each 6,258,602 6,258,602 6,258,602 6,258,602