Page 122 - Continental Reinsurance 2022 Annual Report

P. 122

120 Notes to the Consolidated and separate financial statement - continued

For the year ended 31 December 2022

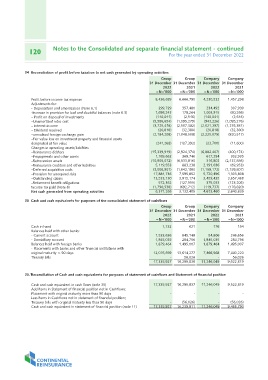

34 Reconciliation of profit before taxation to net cash generated by operating activities

Group Group Company Company

31 December 31 December 31 December 31 December

2022 2021 2022 2021

=N='000 =N='000 =N='000 =N='000

Profit before income tax expense 8,436,689 6,666,790 4,230,532 1,457,298

Adjustments for:

- Depreciation and amortization (Note 6.1) 299,729 357,480 234,492 307,939

-increase in provision for bad and doubtful balances (note 6.3) 1,698,243 178,264 1,003,915 (80,266)

– Profit on disposal of investments (140,041) (2,546) (140,041)

–Unamortized retro cost (5,586,654) (1,095,279) (943,226) (2,546)

– Interest income (3,725,418) (2,507,382) (2,021,397) (1,095,276)

– Dividend received (32,380) (1,276,381)

–unrealised foreign exchange gain (20,818) (1,048,508) (20,818)

–Fair value loss on investment property and financial assets (2,184,208) (2,225,079) (32,380)

designated at fair value (820,517)

Changes in operating assets/liabilities

–Reinsurance debtors (241,268) (127,392) (23,700) (11,600)

–Prepayments and other assets

–Retrocession assets (15,339,919) (2,924,374) (6,882,407) (400,174)

–Reinsurance creditors and other liabilities 1,769,662 369,746 617,294 302,935

–Deferred acquisition costs 316,802

–Provision for unexpired risks (10,905,072) (6,533,816) (2,137,886)

–Outstanding claims 5,119,553 883,238 2,191,036 (69,953)

–Retirement benefit obligations (1,159,172)

Income tax paid (Note 8) (3,008,901) (1,642,196) (1,159,807)

Net cash generated from operating activities 17,884,736 7,595,852 5,720,496 4,303,808

13,533,130 3,815,174 3,459,435 3,657,468

(127,555) (123,206)

572,362 (692,712) 375,033 (178,820)

(1,790,538) 3,132,405 (119,737) 2,640,635

4,613,460

6,371,266

35 Cash and cash equivalents for purposes of the consolidated statement of cashflows

Group Group Company Company

31 December 31 December 31 December 31 December

2022 2021 2022 2021

=N='000 =N='000 =N='000 =N='000

Cash in hand 1,132 621 176 154

Balances held with other banks:

- Current account 1,533,636 845,148 54,806 246,656

- Domiciliary account 1,845,035 284,756 1,845,035 284,756

Balances held with foreign banks 1,879,464 1,495,007 1,879,464 1,495,007

- Placements with banks and other financial institutions with

original maturity < 90 days 12,076,659 13,614,277 7,466,568 7,440,220

Treasury bills - 56,026 - 56,026

17,335,927 16,295,836 11,246,049 9,522,819

35.1Reconciliation of Cash and cash equivalents for purposes of statement of cashflows and Statement of financial position

Cash and cash equivalent in cash flows (note 35) 17,335,927 16,295,837 11,246,049 9,522,819

Add items in Statement of financial position not in Cashflows;

Placement with original maturity more than 90 days -- - -

Less items in Cashflows not in statement of financial position;

Treasury bills with original maturity less than 90 days - (56,026) - (56,026)

Cash and cash equivalent in statement of financial position (note 11) 9,466,793

17,335,927 16,239,811 11,246,049