Page 125 - Continental Reinsurance 2022 Annual Report

P. 125

Notes to the Consolidated and separate financial statement - continued 123

For the year ended 31 December 2022

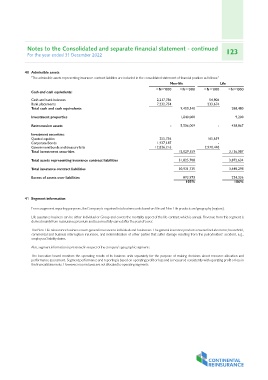

40 Admissible assets

"The admissible assets representing insurance contract liabilities are included in the consolidated statement of financial position as follows:"

Non-life Life

Cash and cash equivalents: =N='000 =N='000 =N='000 =N='000

Cash and bank balances 2,217,786 54,806

Bank placements 7,232,754 233,674

Total cash and cash equivalents

9,450,540 288,480

Investment properties 1,840,000 9,200

Retrocession assets - 5,506,009 - 438,867

Investment securities: 255,756 165,639

Quoted equities 1,937,187 -

Corporate Bonds 12,836,216

Government bonds and treasury bills 2,970,448

Total investment securities

15,029,159 3,136,087

Total assets representing insurance contract liabilities 31,825,708 3,872,634

Total insurance contract liabilities 30,931,735 3,648,298

Excess of assets over liabilities 893,973 224,336

103% 106%

41 Segment information

For management reporting purposes, the Company is organised into business units based on Life and Non-Life products and geography (regions).

Life assurance business can be either Individual or Group and covers the mortality aspect of the life contract which is annual. Revenue from this segment is

derived mainly from reassurance premium and becomes fully earned after the year of cover.

The Non-Life reinsurance business covers general insurance to individuals and businesses. The general insurance products covered include motor, household,

commercial and business interruption insurance, and indemnification of other parties that suffer damage resulting from the policyholders’ accident, e.g.,

employees’ liability claims.

Also, segment information is presented in respect of the company’s geographic segments.

The Executive board monitors the operating results of its business units separately for the purpose of making decisions about resource allocation and

performance assessment. Segment performance and reporting is based on operating profit or loss and is measured consistently with operating profit or loss in

the financialstatements. However, income taxes are not allocated to operating segments.