Page 28 - Continental Reinsurance 2022 Annual Report

P. 28

26 2022 Investment Performance

Review and Report

We are adequately covered in the ageing brackets of 91 days, which will be rolled over to cover other quarters. The Strategies

include:

i. Increase the liquidity in the portfolio from income and collections.

ii. Continued portfolio rebalancing and bond laddering.

iii. A balance of the maturity profile mismatch between retrocession premiums and premium collections.

iv. Convert illiquid assets to liquid assets such as non-performing mutual funds and equities. Residential properties sold off

in 2021 while the case for some unquoted equities is mainly for strategic synergies (Africa Re, Uganda Re and Aveni Re.

6.2 Currency matching

The company matches its liabilities by currency by holding assets in the currencies of liabilities in the various regions, with a

preference in USD. The purpose is to mitigate the impact of exchange losses that may arise from buying currencies to settle

liabilities and/or keeping idle or low-earning currencies' asset class. The company is, however, still exposed to foreign exchange

risk due to other factors that impact foreign exchange movement in all the regional offices' currencies.

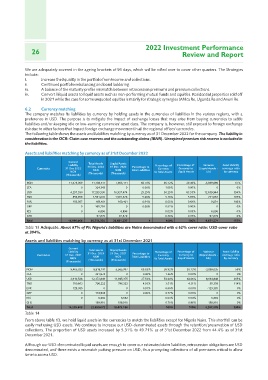

The following table shows the assets and liabilities matching by currency as of 31 December 2022 for the company. The liability in

consideration is the OCR- Claim case reserves and the outstanding claims (IBNR). Unexpired premium risk reserve is excluded in

the liabilities.

Assets and liabilities matching by currency as of 31st December 2022

Currencies Current Total Assets Liquid/Assets Percentage to Percentage of Percentage of Variance Asset liability

Liability 31 Dec. 2022 31 Dec. 2022 Total Liabilities Currency Currency to (Liquid Assets - coverage ratio

31 Dec 2022 Liquid Assets

NGN NGN to Total Assets Lib) by currency

NGN (Thousands) (Thousands)

(Thousands)

NGN 11,673,009 11,108,511 7,863,111 68.70% 36.12% 29.49% -3,809,898 67%

CFA 0 324,343 0 0.00% 1.05% 0.00% 0 0%

USD

TND 4,297,530 17,299,930 16,937,474 25.29% 56.25% 63.53% 12,639,944 394%

EUR 859,959 1,591,626 1,591,626 5.06% 5.18% 5.97% 731,667 185%

GBP 159,567 169,401 169,401 0.94% 0.55% 0.64% 9,834 106%

KES 0 160,784 0 0.00% 0.52% 0.00% 0

GHS 0 6,896 6,896 0.02% 0.03% 6,896 0%

Total 92,829 92,829 1 0.30% 0.35% 92,829 0%

16,990,066 100% 100% 0%

30,754,320 26,661,337 9,671,271 157%

Table 13 Adequate. About 67% of Plc Nigeria's liabilities are Naira denominated with a 62% cover ratio: USD cover ratio

at 394%.

Assets and liabilities matching by currency as at 31st December 2021

Currencies Current Total assets Liquid/Assets Percentage to Percentage of Percentage of Variance Asset liability

Liability 31 Dec. 2021 31 Dec. 2021 Total Liabilities Currency Currency to (Liquid Assets - coverage ratio

31 Dec. 2021 Liquid Assets

NGN NGN to Total Assets Lib) by currency

NGN (Thousands) (Thousands)

(Thousands)

NGN 9,465,033 8,818,191 5,565,997 66.63% 38.92% 30.13% -3,899,035 59%

CFA 0 331,874 0 0.00% 1.46% 0.00% 0 0%

USD

TND 3,910,528 12,372,849 11,945,375 27.53% 54.60% 64.66% 8,034,848 305%

EUR 700,863 796,222 796,222 4.93% 3.51% 4.31% 95,358 114%

GBP 129,385 0 0 0.91% 0.00% 0.00%

KES 0 174,943 0 0.00% 0.77% 0.00% -129,385 0%

GHS 0 6,682 6,682 0.03% 0.04% 0 0%

Total 158,910 158,910 1 0.70% 0.86% 0%

14,205,809 100% 100% 6,682 0%

Table 14 22,659,672 18,473,186 158,910 130%

4,267,378

From above table 13, we hold liquid assets in the currencies to match the liabilities except for Nigeria Naira. This shortfall can be

easily met using USD assets. We continue to increase our USD-denominated assets through the retention/preservation of USD

collections. The proportion of USD assets increased by 5.31% to 49.71% as of 31st December 2022 from 44.4% as of 31st

December 2021.

Although our USD-denominated liquid assets are enough to cover our estimated claim liabilities, retrocession obligations are USD

denominated, and there exists a mismatch putting pressure on USD, thus prompting collections of all premiums critical to allow

time to access USD.