Page 26 - Continental Reinsurance 2022 Annual Report

P. 26

24 2022 Investment Performance

Review and Report

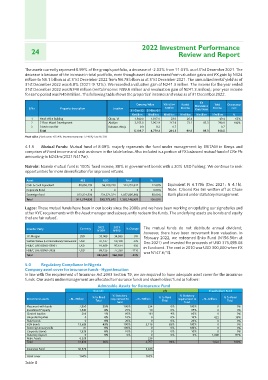

The assets currently represent 8.99% of the group's portfolio, a decrease of -2.03% from 11.01% as of 31st December 2021. The

decrease is because of the increase in total portfolio, even though asset class increased from valuation gains and FX gain by N324

million to N5.1 billion as at 31st December 2022 from N4.78 billion as at 31st December 2021. The annualized rental yield as of

31st December 2022 was 6.8% (2021: 9.12%). We recorded a valuation gain of N241.3 million. The income for the year ended

31st December 2022 was N340 million (rental income: N99.6 million and revaluation gain of N241.3 million); prior year income

for same period was N453million. The following table shows the properties' incomes and value as of 31 December 2022.

Carrying Value Valuation Rental FX Total Occupancy

surplus Income Translation Income rate

S/No Property description Location Gain/(loss)

31-Dec-22 31-Dec-21 N'million

1 Head office Building Olosa, VI N'million N'million 23.0 N'million N'million N'million %

2 7 Floor Mixed Development Abidjan 26.4 83.3 49.4 63%

3 3 bed-room flat Kubuwa, Abuja 1,840.0 1,817.0 217.6 73.2

3,253.8 2,952.9 0.7 290.8 100%

Total 0.7

9.9 9.2 241.3 99.6 83.3

5,103.7 4,779.1 340.8

Head ofce (Fixed assets: 42.54%; Investment property: 57.46%) Cost N3.01b

4.1.5 Mutual Funds: Mutual fund of 8.09% majorly represents the fund under management by BRITAM in Kenya and

comprises of Fixed income and cash as shown in the table below. Also included is a portion of FX balanced mutual fund of CRe Plc

amounting to N243m (2021 N417m).

Nairobi: Nairobi mutual fund is 100% fixed income, 88% in government bonds with a 20% USD holding. We continue to seek

opportunities for more diversification for improved returns.

Asset KES USD Total % Equivalent N 4.179b (Dec 2021: N 4.1b).

Cash & Cash Equivalent 88,050,299 56,200,748 144,251,047 12.00% Note: C/bond Kes 5m written off as Chase

Corporate Bond 0.00% Bank placed under statutory management.

Sovereign Bond 0 0 0 88.00%

Total 823,324,536 234,571,324 1,057,895,860

911,374,835 290,772,072 1,202,146,907 100.00%

Lagos: These mutual funds have been in our books since the 2000s and we have been working on updating our signatories and

other KYC requirements with the Asset manager and subsequently redeem the funds. The underlying assets are bonds and equity

that are fair valued.

Counter Party Currency 2022 2021 % Change The mutual funds do not distribute annual dividend;

N’000 N’000 however, there have been movement from valuation. In

February 2022, we redeemed Enko Fund (N156.56m at

J.P. Morgan USD 35,069 34,958 0% Dec 2021) and invested the proceeds of USD 375,099.08

Scottish Widow (LcI International)/ Monument USD 47,147 50,158 -6% in Eurobond. The cost in 2010 was USD 300,000 when FX

HSB/C LIFE BOND-53001 USD 91,659 97,614 -6% was N147.6/1$.

HSB/C LIFE BOND-3926 USD 69,125 77,330 -11%

Total 243,000 260,059 -22%

5.0 Regulatory Compliance In Nigeria

Company asset cover for insurance funds - Hypothecation

In line with the requirement of Insurance Act 2003 Section 19, we are required to have adequate asset cover for the insurance

funds. Our assets under management are allocated to insurance funds and shareholders' fund as follows:

Admissible Assets for Reinsurance Fund

Non Life Life Shareholders' Fund

Investment assets =N='Million % to Fund % Statutory =N='Million % to Fund % Statutory =N=Million % to Fund

Total requirement to Total requirement to Total

Placement with banks 7,950 0

Investment Property 1,840 fund fund 0 0%

Quoted Equities 0 0%

Unquoted Equities 256 25% 100% 234 6% 100% 622 0%

State bonds 0 6% 25% 10 0% 35% 0 38%

FGN Bonds 0 1% 50% 161 4% 50% 0 0%

SovereignTreasury Bills 0% 10% 0 0% 10% 0 0%

Corporate Bonds 13,589 0% 20% 0 0% 20% 0 0%

Statotory deposit 37 83% 1,000 0%

Retro Assets 43% 100% 3,116 0% 100% 62%

Total 1,939 0% 100% 0 0% 100%

0 6% 0 0%

0% 10% 0 10%

6,225 0% 94% 0%

31,836 80% 236

3,757 1,622 100%

Insurance Fund 30,578 3,635

Asset cover 104% 103%

Table 8