Page 24 - Continental Reinsurance 2022 Annual Report

P. 24

22 2022 Investment Performance

Review and Report

Placement with banks: These are purely money market instruments in Term Deposits. The asset decreased by -3.06% year on

year from 13.38b as of 31st December 2021 to N12.97 billion as of 31st December 2022 and represents 22.83% of our portfolio;

during the year, we committed some of the cash to Federal Government Bonds. Relative to the budget, the asset class is lower than

the budget allocation by N3.56 billion due to lower collections. The cash allocation in the books of CRe Plc, Douala, Nairobi, and

Gaborone are %, 18%, 11% and 52.61% respectively. Overall, the allocation to total portfolio value was 22.83% as of 31st

December 2022 (Q32022: 19.17%Q22022: 19.74%; Q12022: 20.24%; Q42021: 30%).

The yield on the asset class was 4.27% (2021: 5%) and it represents the average of the rates on bank placements across the

various currencies compared with the budget yield of 5.05%. The return on cash and cash equivalent is partly driven by the

currency composition of the asset class and the total amount available for investment and impacted by the monetary policy stance

in various countries. We increased our USD term deposits. The government in various countries adopted tight monetary policy in

response to inflationary pressure and raised the Monetary Policy Rates. This resulted into increase in short term rates in some

economies, however, Nigeria short term rates remain subdued as at the end of Q42022.

The tables below show the currency distribution of cash components of our portfolio as of 31st December 2022:

Group – 31 December 2022

Currency =N= USD KES CFA GBP TND BWP EUR GHC Total

Amount (N'million) 2,157 6,600 998 1,182 0 1,592 216 169 56 12,969

% Weight 8% 9% 12% 2% 1% 0%

17% 51% 0% 100%

Group – 31 December 2021 Total

13,369

Currency =N= USD KES CFA GBP TND BWP EUR GHC

Amount (N'million) 1,395 7,711 152 2,155 0 796 1,101 0 59 100%

% Weight 1% 16% 6% 0%

10% 58% 0% 8% 0% Total

8,184

45% (Dec 2021: 51%) held in USD. Decline due to allocation to Bonds. 100%

Group – 31 December 2022 Total

7,442

Currency =N= USD KES CFA GBP TND BWP EUR GHC 100%

Amount (N'million) 0 1,592 169 56

% Weight 2,157 4,203 7 00 2% 1%

0% 19%

26% 51% 0% 0% 0%

Group – 31 December 2021

Currency =N= USD KES CFA GBP BWP TND EUR GHC

Amount (N'million) 0% 59

% Weight 1,395 5,185 7 0 796 1%

19% 70% 0% 0% 0% 0% 11%

51% (Dec 2021: 70%) held in USD. Decline due to allocation to Bonds.

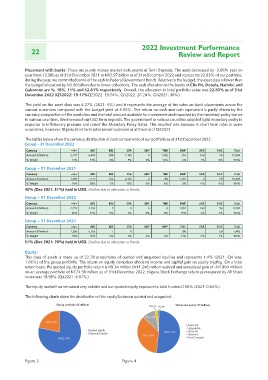

Equity:

This class of assets is made up of 22:78 proportions of quoted and unquoted equities and represents 1.4% (2021: Q4 was:

1.66%) of the group portfolio. The return on equity comprises dividend income and capital gain on equity trading. On a total

return basis, the quoted equity portfolio return is N9.34 million (N11.246 million realized and unrealized gain of -N1.904 million)

on an average portfolio of N174.56 million as of 31st December 2022; Nigeria Stock Exchange return as measured by All Share

Index was 19.98% (Q42021: 6.07%).

The equity market has remained very volatile and our quoted equity exposure to total funds is 0.56% (2021: 0.64%).

The following charts show the distribution of the equity between quoted and unquoted:

Equity portfolio (N’million) N13, 2% N5, 1% Unquoted equity (N’million)

N63, 10%

N174, 22% Quoted equity N324, 52% Aveni-Re

N622, 78% Unquoted equity Uganda Re

N217, 35% Africa Re

Gthomes

Food Concept

Figure 3 Figure 4