Page 137 - Continental Reinsurance 2022 Annual Report

P. 137

Notes to the Consolidated and separate financial statement - continued 135

For the year ended 31 December 2022

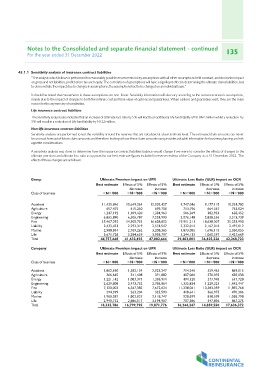

43.1.1 Sensitivity analysis of insurance contract liabilities

“The analysis which follows is performed for reasonably possible movements in key assumptions with all other assumptions held constant, and shows the impact

on gross and net liabilities, profit before tax and equity. The correlation of assumptions will have a significant effect in determining the ultimate claims liabilities, but

to demonstrate the impact due to changes in assumptions, the assumptions had to be changed on an individual basis.”

It should be noted that movements in these assumptions are non–linear. Sensitivity information will also vary according to the current economic assumptions,

mainly due to the impact of changes to both the intrinsic cost and time value of options and guarantees. When options and guarantees exist, they are the main

reason for the asymmetry of sensitivities.

Life insurance contract liabilities

The sensitivity analysis also indicates that an increase of Ultimate loss ratio by 5% will lead to an additional Life fund liability of N184m million whilst a reduction by

5% will result in a reduction of Life fund liability by N122 million.

Non-life insurance contract liabilities

Sensitivity analyses are performed to test the variability around the reserves that are calculated at a best estimate level. The estimated claim amounts can never

be an exact forecast of future claim amounts and therefore looking at how these claim amounts vary provides valuable information for business planning and risk

appetite considerations.

A sensitivity analysis was done to determine how the insurance contract liabilities balance would change if we were to consider the effects of changes to the

ultimate premium and ultimate loss ratio as opposed to our best estimate figures included in reserve reviews of the Company as at 31 December 2022. The

effects of these changes are as follows:

Group Ultimate Premium impact on UPR Ultimate Loss Ratio (ULR) impact on OCR

Class of business Best estimate Effects of 5% Effects of 5% Best estimate Effects of 5% Effects of 5%

Accident decrease increase decrease increase

Agriculture

Energy =N='000 =N='000 =N='000 =N='000 =N='000 =N='000

Engineering

Fire 11,425,846 10,649,264 12,202,427 9,747,046 9,177,115 10,324,782

Liability 657,475 615,250 699,700 713,796 664,567 763,024

Marine 506,369 382,953 638,452

Life 1,247,192 1,109,420 1,384,963

Total 6,865,890 6,506,787 7,224,993 3,076,148 2,838,556 3,313,739

15,467,292 14,305,731 16,628,852 19,911,211 18,638,307 21,253,990

Company 2,433,433 2,292,319 2,574,547

2,988,814 2,769,262 3,208,365 2,332,014 2,167,016 2,497,012

Class of business 3,671,728 3,384,659 3,958,797 1,873,085 1,696,115 2,050,055

44,757,668 41,632,693 47,882,644 1,244,133 1,060,597 1,427,669

Accident 39,403,801 36,625,226 42,268,723

Agriculture

Energy Ultimate Premium impact on UPR Ultimate Loss Ratio (ULR) impact on OCR

Engineering

Fire Best estimate Effects of 5% Effects of 5% Best estimate Effects of 5% Effects of 5%

Liability

Marine decrease increase decrease increase

Life

Total =N='000 =N='000 =N='000 =N='000 =N='000 =N='000

1,802,690 1,582,134 2,023,247 714,240 559,465 869,015

366,645 341,408 391,882 407,066 376,093 438,038

494,120 377,941 617,728

1,221,142 1,083,371 1,358,914 1,335,834 1,229,221 1,442,447

2,629,808 2,473,752 2,785,864 11,238,061 10,583,359 11,892,764

7,120,003 6,567,382 7,672,624 418,641 366,975 470,306

928,699 818,599 1,038,798

294,399 263,204 325,593 707,586 547,896 867,275

1,960,387 1,802,027 2,118,747 16,244,247 14,859,550 17,636,372

2,940,712 2,686,517 3,194,907

18,335,786 16,799,795 19,871,776